“Hi, my name’s Mike… and I bought silver at $120.”

“Hi, Mike.”

“I just paid twelve hundred bucks for a 10 oz bar because everyone said double digit silver was dead and gone.”

Sympathetic sighs..

“The next day, spot dropped like a rock as I stared at the charts on TradingView. I felt personally betrayed.”

More sympathetic sighs….

Welcome to precious metals therapy.

If you have been stacking silver for more than a few months, you have probably had a moment like this. Price starts ripping. Headlines get LOUD. Everyone suddenly becomes an expert. So you buy, and buy, and maybe you buy some more.

Almost like clockwork, the dip shows up right after you lock in a BIG order.

Here is the part nobody tells you. It does not mean you are bad at stacking. It does not mean you missed your chance. And it certainly does not mean you should panic sell.

It just means you are human.

Even the guy who runs the bullion shop like me does it sometimes.

This Happens Every Cycle

Here is the funny thing about stacking. Everyone thinks they will be the calm, rational buyer who picks up metal when prices are boring and ignored. Nobody plans on buying the vertical spike. And yet almost everyone does it at least once in their lifetimes.

Markets do not move on logic. They move on emotion.

When silver sits flat for months, nobody cares. Inventory collects dust and the phone barely rings. But when spot price starts moving fast, everything changes. It is on the news, your buddy is texting lines on charts, and every headline says this is the last chance before it goes higher.

That pressure makes people act. Not because they are reckless, but because there becomes an urge to respond.

After watching this business for years, I can tell you it is the same cycle every time. The public gets excited near the top and bored near the bottom. Which means most people accidentally buy high and hesitate when prices retreat lower.

So if you bought a spike, do not beat yourself up.

You just paid a little tuition to the market like the rest of us.

Stacking Should Be Boring

At some point I realized most of the stress in stacking comes from trying to time everything perfectly. People wait for the perfect dip, chase every breakout, and refresh spot prices all day like they are trading stocks. It is exhausting, overwhelming, and in our humble opinion, not really what precious metals are for.

Gold and silver are not day trades or lottery tickets. They are tangible savings. They are insurance. They are the boring part of your net worth that quietly does its job.

When you treat metals like a trade, every move feels personal. A drop feels like a mistake. A rally without you feels like you missed out. When you treat them like long term savings, most of that emotion disappears.

You are not trying to be a genius.

You are just steadily turning dollars into ounces.

Once I made that shift, stacking became a lot simpler and a lot calmer.

The Boring Fix That Actually Works

If trying to time the market is stressful and unreliable, the alternative is simple. Buy on a schedule and stop worrying about the price. At least don’t worry so much.

That is all dollar cost averaging really is. You pick a fixed dollar amount and buy at regular intervals no matter what the chart looks like. No predictions. No waiting for the perfect dip. No second guessing.

Some months you will buy higher. Some months lower. Over time it blends together into an average price that usually beats the person trying to outsmart every move.

More importantly, it removes emotion. You stop asking whether today is the top and start focusing on steady progress.

After years of watching regular customers, calm and consistent stackers all do some version of this. They treat metals like a bill they pay to themselves every month.

It is not exciting.

But it works.

Think in Ounces, Not Dollars

One small mindset shift makes stacking even easier. Stop thinking in dollars and start thinking in ounces.

Most people obsess over the exact price they paid and track every small move up or down. That makes sense with stocks, but metals are different. They are something you accumulate, not something you constantly trade.

It’s smart to keep track of your purchases on a spreadsheet for later reference, but the goal is not to perfectly time each purchase. The goal is simply to add weight over time at reasonable prices.

When you buy steadily, day to day swings start to matter less. A small drop does not feel like a mistake. A spike does not feel like an emergency. It is just noise while your stack slowly gets heavier.

After a while you stop asking, “Did I buy at the top?” and start asking, “How many ounces do I have now?”

Stress levels decrease and everything simplifies.

Why I Like 10 oz Bars

Once you start buying regularly and focusing on ounces instead of price, the next question gets simpler. What should you actually buy each time?

For most people, it helps to stick with common, boring, easy to resell products. Nothing exotic. Nothing complicated. Just simple pieces that are recognizable and liquid.

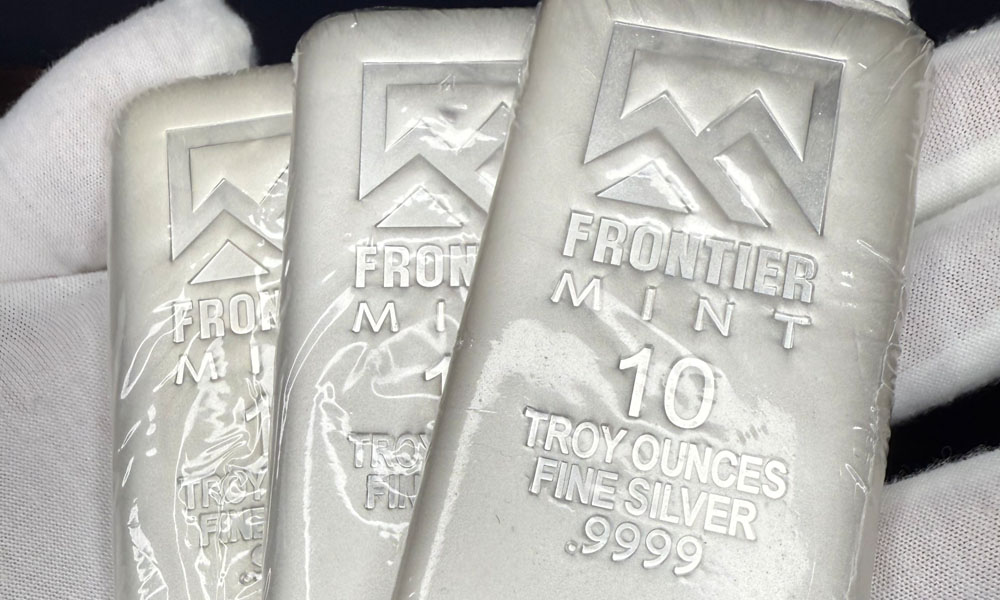

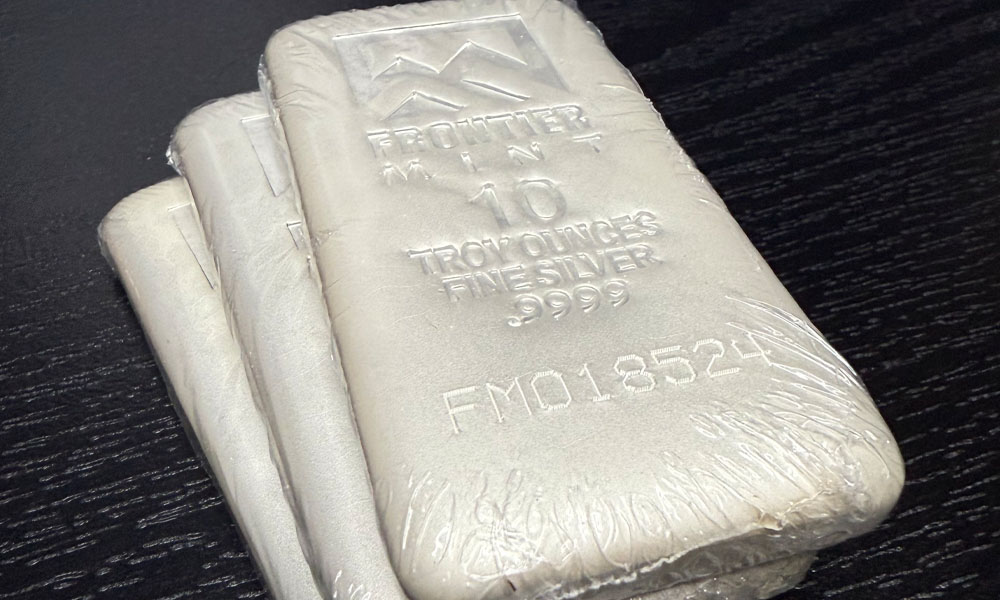

That is why I keep coming back to 10 oz silver bars.

They are big enough to feel substantial, but not so large that you are stuck trying to move a hundred ounces at once. They stack neatly, store easily, and you can sell a few at a time if you ever need liquidity. It is a nice middle ground between one ounce bullion coins and giant silver bricks.

And honestly, they just feel like real money.

There is something about holding a solid chunk of silver that makes the whole idea click. It feels tangible and permanent, like something you can put in a safe and forget about for ten years. Every time I pick up a 10 oz bar, I half joke that it feels like something out of Looper, stashing away future money for Old Mike.

Lately we have been moving a ton of Frontier Mint 10 oz silver bars for exactly that reason. Nothing too fancy. Just clean, stackable weight at a fair price that fits perfectly into a steady dollar cost averaging routine.

A Simple Plan If You “Bought the Top”

If you bought silver high and now find yourself second guessing the timing, the next step is simpler than most people think. There is no need to panic sell, swing for the fences with one big order, or sit on the sidelines waiting for the perfect dip.

Start by accepting that the price you paid is already in the past. Everyone who stacks long enough has a few purchases they wish they had timed differently. It is part of participating in any market.

Set a small, comfortable monthly buy amount and pick a day where the tickers are showing red. Focus on simple, liquid products and add steadily over time. The goal is consistency, not perfection.

Most people buy metals for the long run anyway. For savings and tangible, financial protection. That reason does not change just because one order happened to be a little high.

As those regular purchases stack up, your average cost smooths out and what once felt like “buying the top” turns into a small blip inside a much larger stack.

A year or two from now, you probably will not remember the exact number you paid.

You will just have more metal.

And that is what actually matters.

Final Thoughts

If you've ever bought silver at a local top (and that's what $120 ultimately is), welcome to the club.

Every lifelong stacker has at least one order they wish they could redo. The difference between people who succeed and people who quit is not timing. It is simply whether they keep going.

So keep it simple. Buy on a schedule. Focus on ounces. Stick with products that are easy to stack and easy to sell. Put a few bars away, close the safe, and get on with your life.

You do not need perfect timing.

You just need consistency.

And if you ever catch yourself staring at a receipt thinking, “Man, I really bought that one at the top,” don’t worry.

There is always a folding chair waiting at precious metals therapy.

We have all been there.