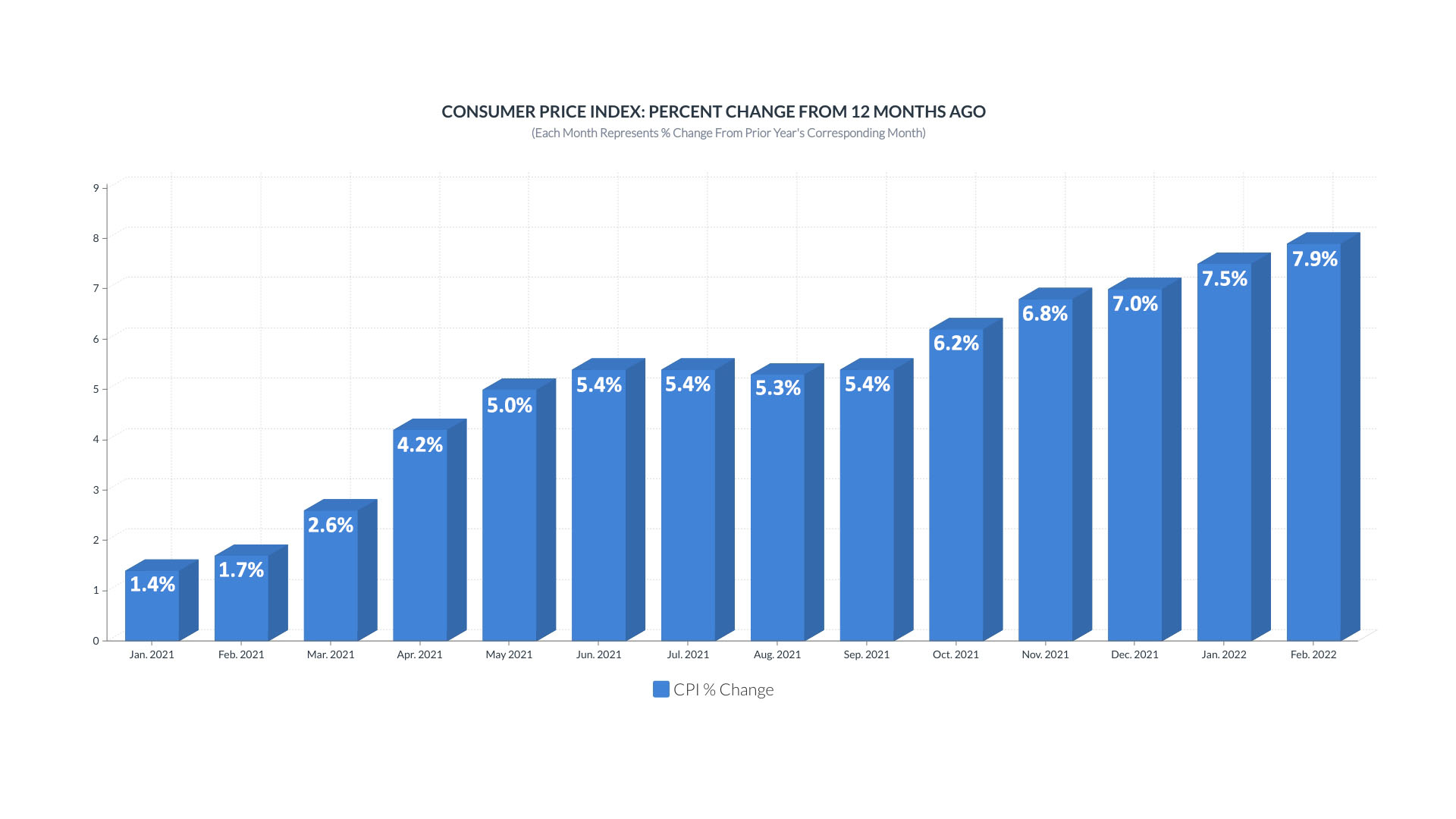

We're only three months into the new year, and soaring inflation, as measured by the Consumer Price Index (CPI), is already putting a damper on everyone's big plans for the rest of 2022. We're feeling excessive pain at the pump and the checkout line as gas, groceries, and retail goods are pushing record highs!

Official CPI figures continue inching up and up every month and are expected to continue through at least the end of 2022.

A less publicized but equally important figure, the Producer Price Index (PPI), continues breaking all-time highs and will likely keep retail prices at an elevated level. PPI measures businesses' input costs to produce and provide retail goods and services. These costs are a factor of what we pay for everyday items, and with PPI reaching fresh all-time highs month after month, it's becoming clear that inflationary pressures will be around for some time to come.

This is not a problem that can be ignored but rather must be tackled head-on.

Here are some actionable steps to become better prepared:

1. Cut Inflation Off at the Source by Reigning in Your Monthly Expenses

Short of saving a receipt for company expense reimbursements, we usually wad up those paper strips and toss them in the nearest trash bin. But to beat rising consumer costs, we must eliminate financial waste and become more fiscally responsible. Compile and track every receipt from your monthly living expenses and look at what is non-essential or where you can cut back. Creating a simple list of where money is spent during an average month can be an eye-opening experience.

Another trick includes reviewing your bank account and credit card statements for any recurring charges that are buried or overlooked. Monthly subscriptions that innocently started as a free 7-day trial start adding up and if they aren't providing any value, now is a great time to reassess. You don't need to cut out every guilty pleasure, but taking a closer look at your statements may assist in identifying and trimming unnecessary expenses.

2. Conquer Rising Inflation: Buy in Bulk and Stock Up Whenever Possible

Warehouse stores such as Costco and Sam's Club have become increasingly popular, and for good reason. With smart planning and prioritization, everyone can lower their monthly grocery bill through bulk purchasing. Stocking up on non-perishables saves money during periods of high inflation and can help everyone be prepared for any future shortages.

With the world reopening, we want to take advantage of every opportunity to get out of the house. A reservation at that trendy restaurant with the phenomenal Yelp reviews is a great way to support your local economy but also gets expensive if done regularly. Try cooking more at home; Air Fryers are all the rage and a convenient way to prepare simple, nutritious meals with plenty of eye-appeal for your Instagram posts!

Unless you have a spare fuel tanker at your disposal, stocking up on fuel isn't a viable option, but many warehouse stores offer their members access to affordable gas. We all know that the lines at the Costco pumps look a bit daunting, but if you can manage your time and fit it into your schedule, the wait times are fairly tolerable. Timing is everything, and if you fill up outside of regular store hours, Costco and Sam's Club have the cheapest pumps around.

On a side note, it doesn't hurt to negotiate a flexible work-from-home arrangement. Fewer trips to the office mean fewer trips to the pump.

3. Pay Off or Consolidate Outstanding Credit Card Debt

In an effort to tame inflation, the Federal Reserve raised the Fed Funds Rate 0.25% in March and have signaled for six additional rates hikes over the remainder of 2022. Assuming each increase is only 0.25%, that would constitute a 1.75% increase to the Fed's benchmark interest rate. This rate directly impacts credit card interest rates and adjustable and fixed-rate debt issued going forward.

Anyone carrying sizeable amounts of adjustable-rate debt is about to spend more each month on interest payments alone. It's estimated that as of 2019, the average cardholder had $6,194 of credit card debt. Carrying that average balance into looming interest rate hikes, you will be looking at an additional $108 in annual interest based on conservative estimates.

It's an excellent time to pay down that debt or explore options for consolidating adjustable-rate debt into a more manageable, fixed-rate package.

4. Build an Emergency Fund, but Don't Overdo It

After squaring away unnecessary expenses, the task of setting aside cash for a rainy day becomes straightforward. A washer or dryer that suddenly breaks can spell disaster if funds are low and your options are limited. For reasons discussed in point #3 above, taking on new debt in inflationary environments becomes increasingly costly.

$1,000 or even just $500 sitting in the bank, readily available to cover an emergency expense, can be a life-saver. But it’s important to not to get carried away, as your cash is losing purchasing power at a faster rate than the historical average.

A solid emergency fund that one can fall back on will help keep you out of debt, but holding too much cash can spell disaster for your long-term purchasing power. Strike a good balance between short-term, cash liquidity, and acquiring assets that counteract the forces of inflation.

5. Hold Assets with a Solid Track Record Against Inflation

The traditional, balanced portfolio isn't going anywhere but might need some rethinking in the times we're entering. Quality, blue-chip stocks, and index funds should perform adequately over the long term, but many company valuations currently sit at eye-watering levels and finding value can prove challenging.

Real estate can be an excellent asset for weathering inflationary storms and providing a steady stream of cash. But similar to stocks, investors seeking a value play are just about out of luck, with real estate also sitting at record highs. Real estate investments also tend to be illiquid, and while Real Estate Investment Trusts (REITs) vehicles offer better accessibility for the masses, they have ongoing maintenance fees to consider.

Gold and Silver are stable assets with a proven track record and history on their side.

As with any tangible asset, movement into and out of the market must be planned; you can't just push a button and transfer funds to your bank account. There are also dealer premiums to overcome when transacting with physical precious metals. These "premiums" are the cost of producing and delivering retail gold and silver bullion to your front door. Still, they exist to cover business operational costs and provide exceptional customer service.

At PIMBEX, we work diligently to keep our premiums reasonable and offer some of the lowest prices in the industry!

The Bottom Line

You don’t have to give up all of life’s little indulgences during times like these, but planning and a little foresight can go a long way as the world around us becomes more expensive. There's no shame in being thrifty.