When most people picture buying gold, they imagine a miserly Scrooge McDuck diving into his enormous pile of gold coins or pirates embarking on a high-seas adventure for buried treasure.

Gold is the absolute stuff of legends, but real-life bullion ownership tends to be less swashbuckling. Sorry, we don’t mean to be such downers!

But gold is a topic that both fascinates and bewilders all walks of life, and we want to help you cut through the noise.

First, it’s essential to understand that gold bullion is simply the physical metal you hold in your hands and that it comes packaged in various forms.

Between investment-grade bars and coins, retail jewelry and high-tech, industrial applications, gold’s use cases are limitless.

Today we’ll lay out all the details of who is buying gold bullion, how much gold they’re buying, and why they can’t get enough.

Alright, let’s get started.

Gold Jewelers

The tradition of gift-giving isn’t entirely clear, but we do know it extends back thousands of years and perhaps even pre-dates recorded civilization. Ancient Egyptians, the Romans, and many early religions had customary gifts and bestowed presents as displays of affection. Today, holidays and special occasions are the primary reason for exchanging presents.

Gifts commonly consist of low-priced consumables or even just cash because it’s easy and removes all the guesswork. Gold jewelry is another popular choice but differs in that it’s both expensive and thoughtful in nature. Gold jewelry such as necklaces and luxury watches are comprised of varying purities of gold bullion, usually 14-karat (58.3%) or 18-karat (75%), and have the opportunity to appreciate in value over time. This unique feature is why gold jewelry often becomes family heirlooms, but do your homework and always be mindful of high markups.

A large percentage of demand comes from India, where gold jewelry is frequently gifted for ceremonial reasons. In addition, the Rupee has endured multiple currency crises, enlightening the local populace to the dangers of paper currency over-dependence.

Gold jewelry production in 2021 required over 2,448 tons of gold bullion, making it the most significant driver of demand. As gold jewelry serves a dual purpose in both gift-giving and discreet wealth storage, this trend is likely to continue well into the future.

*2021 demand - 2,448.18 tons; 2022 (Q1) demand - 570.78 tons

Retail Investors (Small Coins and Bars)

Gold coins and bars are popular avenues for retail investors to add precious metals to their portfolios. Whether taking physical delivery or storing with a vaulting service, purchasing the actual metal provides a level of comfort other investments cannot.

Investment-grade gold bars range in size from one gram, around the size of that tiny chip in your credit card, up to 400 troy ounce vault bars that weigh over 27 pounds each! The same goes for gold coins, but coins are most widely produced in the one troy ounce class to satisfy broad retail investment demand.

Gold bullion products undergo a lengthy fabrication process before being ready for the retail investor. Sovereign and private mints worldwide expend considerable effort converting those 400oz gold bars into smaller, more divisible coins and bars.

The mints begin by purchasing 400oz bars from the gold markets for about the metal’s spot price. These gold bars, considered too big for general retail investment, are melted down and either minted or cast into smaller, more divisible coins and bars. These standard weights are more affordable and include:

- Fractional troy ounce gold coins.

- One troy ounce coins and bars.

- Ten troy ounce gold bars.

- 1-kilo (32.15 troy ounces) gold bars.

PIMBEX works directly with these recognized mints and trusted suppliers to deliver investment-grade gold directly to anyone’s front door, fully insured and discreetly packaged.

*2021 annual demand - 1,301.14 tons; 2022 Q1 demand - 310.74 tons

Central Banks

Gold is the most stable asset in history, and every national institution prudently recognizes the yellow metal’s value. Even decades removed from any classical gold standard, our global financial system still purchases gold bullion in serious quantities and vaults in their reserves.

Internationally, Central Banks purchase a staggering amount of gold bullion year in and year out. Including gold on their ever-expanding balance sheets provides (some) stability that other assets do not. Irresponsible deficit spending and trade deficits are a universal phenomenon, not contained to merely the United States.

While troubled assets like mortgage-backed securities weigh on the long-term health of the Federal Reserve’s balance sheet, gold provides strength. Many Central Banks on the European continent, China, Russia, and India, have all stepped up their gold purchases recently.

Large institutions such as these Central Banks almost exclusively trade the interchangeable 400oz gold vault bars mentioned previously. These colossal gold bricks, refined to a minimum 99.5% purity, are delivered to London Bullion Market Association (LBMA) vaults and equivalent vaulting agents. These include the COMEX futures market in the US and the Shanghai Gold Exchange, which house a large percentage of these standardized gold vault bars.

*2021 demand - 510.45 tons; 2022 (Q1) demand - 92.37 tons

Gold Exchange Traded Funds (ETFs)

Investors turn to gold ETFs when seeking price exposure to the precious yellow metal but don’t want to take delivery of any tangible product. Shares in a gold ETF trade hands like common stock and derive value from their direct gold backing. As a gold ETF issues more shares, it must claim title to vaulted gold to back the fund.

Many gold investors become nervous about the leap of faith required to assume their shares are fully backed at all times by the underlying metal. Additionally, the average joe investor would never be able to take physical delivery of their investment if the need ever arose. This lends credence to the famous expression, “if you don’t hold it, you don’t own it.”

Either way, gold ETFs are a prevalent investment vehicle and pulled over 296 tons of gold off the market in the first quarter of 2022. After selling off almost 191 tons in early 2021, it will be interesting to see if the record demand trend in 2022 continues through the end of the year.

*2021 net sell off - 190.98 tons; 2022 (Q1) demand - 296.30 tons

Industry and Technology

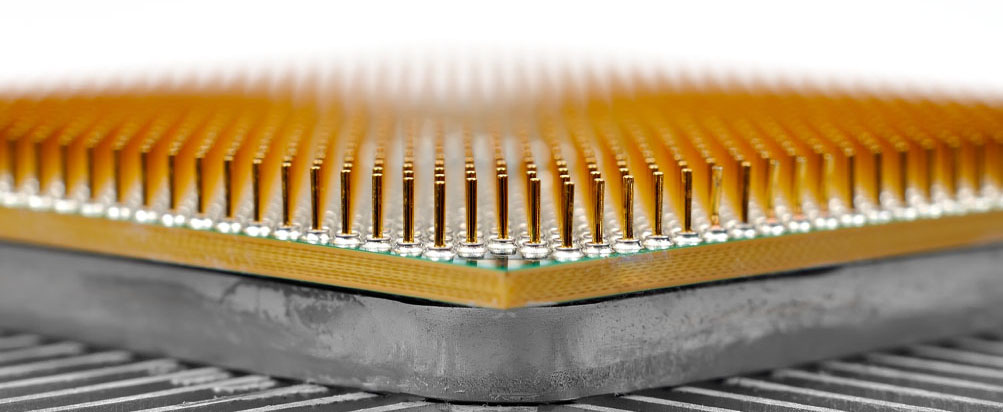

Gold exhibits unique physical properties, and humans have discovered many industrial uses for the element. Its resistance to corrosion, high conductivity, and malleability make gold an excellent option for high-tech applications.

Computer chips in consumer electronics such as cellphones, tablets, and laptops use gold-plated connections to ensure reliable operation. While each of these computer chips only contains a few dollars worth of gold, it adds up when you consider the millions of electronics produced each year.

Additionally, solid-state hard drives, a rapidly growing technology, and the massive data centers and server farms required to operate cloud-computing services need lots of gold to function.

Gold compounds are used in biomedicines to treat rheumatoid arthritis and in cutting-edge cancer research. Aerospace applications, where safety is paramount, heavily rely on gold to form critical connections that resist failure. Gold truly is a miraculous element of nature, and its uses are endless!

*2021 demand - 363.94 tons; 2022 (Q1) demand - 90.06 tons

Why Everyone’s Buying Gold

Gold is a store of value and a safe haven asset that shelters our portfolios during economic downturns and times of political turmoil. It’s also a critical component in many facets of our economy, both monetarily and industrially.

The performance of gold and other precious metals is typically uncorrelated with other traditional investment classes, such as stocks and bonds. Investors of all experience levels seeking to protect their hard-earned savings invest in gold through at least one of the vehicles listed above.

Since the Great Recession of 2008, savvy individuals have realized the need for alternative investments in their portfolios. The recent pandemic renewed this interest, but 2020 felt like a complete paradigm shift.

Fifteen years ago, the average person wasn’t concerned with the monthly Federal Reserve meeting minutes, Consumer Price Index numbers, or constant discussions of interest rate hikes. A lot has changed, and the old 60/40 cookie-cutter investment approach doesn’t go far enough in this current economic climate. It’s wise to plan accordingly, and we’re always here to help.

So, while we can’t know for sure how many gold buyers are filling wooden treasure chests with precious metals or swimming in a pool of gold coins. We can predict that most gold buyers are investing modestly to take control of their financial future and protect themselves from the rough seas ahead.

*Source: World Gold Council