Silver is an irreplaceable, wonder element with unique scientific properties. Heavy, dense, yet soft and incredibly malleable, pure silver is the finest known conductor of heat and electricity. Silver fulfills an array of industrial roles and observes strong retail demand for its use as a store of value, fine jewelry, and silverware.

Our relationship with the lustrous precious metal dates back over 4,000 years, and silver once circulated as coined money across various civilizations. Now entirely demonetized, silver is held within investor’s portfolios as an inflation hedge and deliberate bet against ongoing currency devaluation.

Today we’ll look at the silver markets, the future prospects for silver as an investment, and why it’s been so darn difficult to keep retail silver on the shelves!

Silver Market Dynamics

Investment-grade silver enters the domestic market through several sources, including new mining ventures, recycling efforts, and imported from abroad. New silver stockpiles are mined from concentrated ore deposits and smelted onsite into semi-pure doré bars. These doré bars are then transported to refining facilities, refined to investment-grade purity, and fabricated into 1000 oz commercial bars.

Domestic US production of mined silver in 2021 totaled 1,000 metric tons, and silver recycling accounted for 650 metric tons. The remaining 80% of US annual consumption was sourced from foreign suppliers, primarily Mexico and Canada.

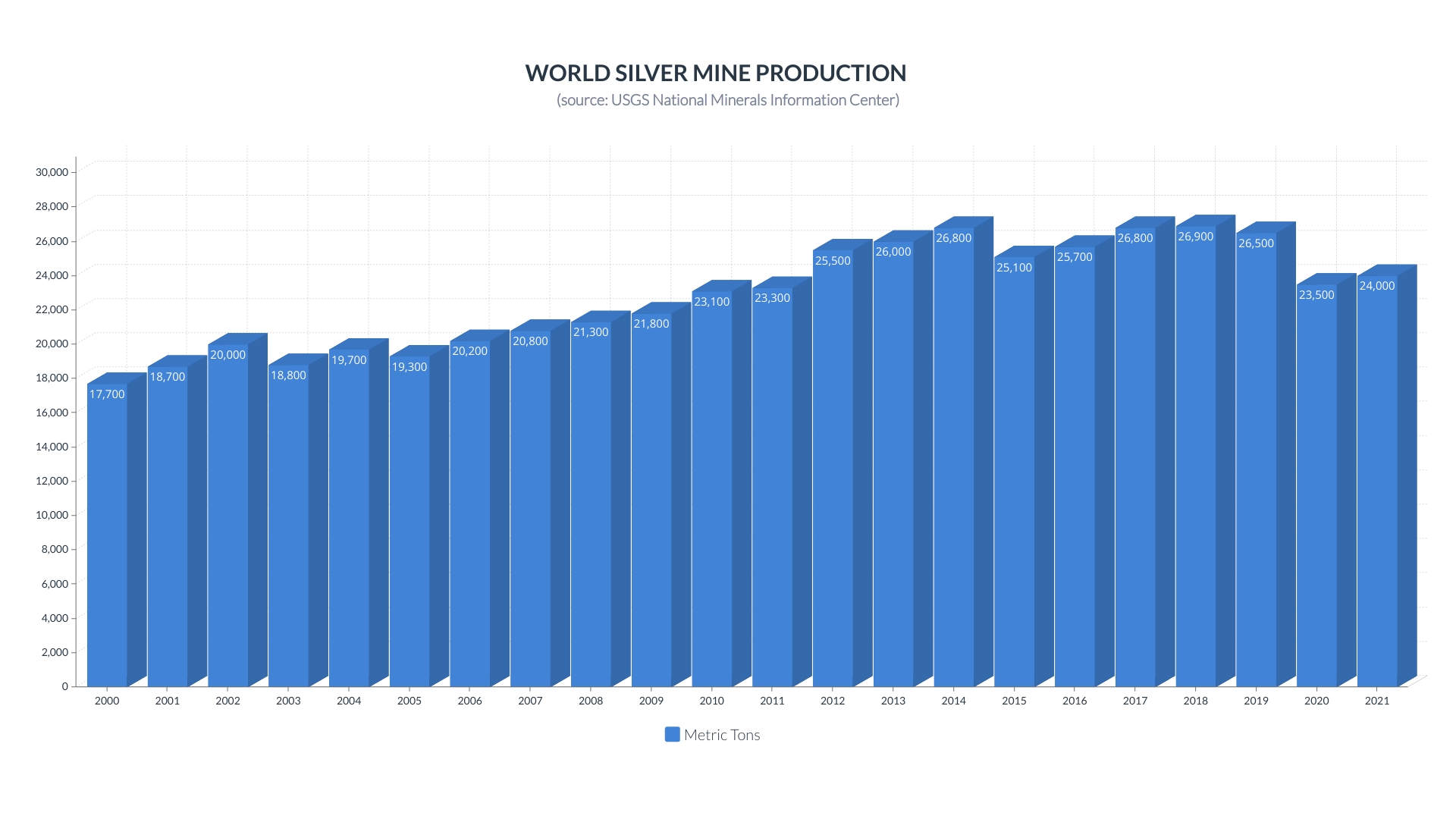

2021 annual global mining production reached 24,000 metric tons (or 772 million troy ounces), an increase of 500 metric tons from 2020. It’s noteworthy that most silver mining occurs as a byproduct of gold, copper, zinc, or lead mining production.

On the demand side, the growing use cases for silver have only increased industrial consumption. New applications are abundant as the metal creates the best electrical connections that power an array of electronic devices we use every day.

Smartphones, computers, switches in vehicles, and more require silver electrodes to make everything work. Rechargeable silver oxide batteries, components inside catalytic converters, and photographic film also continue to bolster silver demand.

Many future technologies in the renewable energy sector heavily rely on silver and will serve to expand consumption going forward. Photovoltaic energy solutions such as solar panels utilize silver to convert sunlight into electricity for the growing power grid.

The rapidly growing fleet of electric vehicles relies heavily on silver to create the connections between the dozens of onboard batteries and computers that power the car. And don’t forget the charging stations popping up everywhere, those need silver too. Elon Musk has teased buying a lithium mine, another critical component in electric vehicles, to secure resources and keep Tesla production costs low. We wouldn’t be surprised if Elon took steps to purchase a silver mine as well.

2021 is the fifth straight year that investment demand for retail coins and bars has increased. 2021 witnessed a dramatic increase of 26% over the prior year, up to an estimated 250 million troy ounces.

Retail Silver Market Insights

In 1980, the Hunt Brothers brought considerable attention to the silver markets through their alleged attempt to corner the market. Fear of rampant inflation eroding their family’s oil fortune, the Hunts stockpiled over 100 million ounces of silver bullion bars and increasingly purchased leveraged silver positions through the commodities futures exchange or COMEX. The price of silver went parabolic, briefly pushing over $50 per troy ounce. Unfortunately for the Hunts, following a sudden (and controversial) COMEX rule change, they were forced to close their massive futures positions, and the silver price collapsed. The Hunts declared bankruptcy, and their efforts to overcome inflation were thwarted. This story is a case study on why paper silver products are best avoided.

Falling out of favor, silver traded sideways for the better part of three decades. Silver market interest reignited following the Great Recession of 2008. All of the counterparty risk the Big Banks had accrued, caused irresponsible government bailouts and ensuing rounds of Federal Reserve money printing. Experienced investors recognized the need for precious metals, and this demand ignited a precious metals bull run, pushing gold and silver prices to record highs. Unfortunately for metals, the continued money creation and record low interest rates also created a stock market and real estate boom. Gold and silver again fell out of favor.

In March 2020, a black swan event shocked the world, causing a paradigm shift for gold and silver. Ensuing shutdowns from the Covid-19 virus and the anticipation of economic turmoil led to a sudden stock market collapse. There were massive equity selloffs from institutions and day traders. These groups were forced to liquidate their gold and silver leveraged positions to cover the margin calls on their losing equity positions. This created a cascading effect into precious metals where gold and silver plummeted to approximately $1,450 and $12, respectively.

Immediately following, retail inventories were completely wiped out. Savvy investors bought the dip. But now in a shutdown economy, retail silver production was crippled, and retailers were sold out for several months. Retail production was back on track by mid-2020, but still struggled to keep up.

It’s important to note that retail production always catches up, but in early 2021 the shelves were again cleaned out by the fabled Silver Squeeze movement. Demand was unprecedented, bringing the retail market to its knees and again thrusting the precious metal industry into the spotlight if only briefly. Still, retail demand has continued to be incredibly strong even to this day.

What’s Next?

Now in April 2022, inflation is running red hot. We’re witnessing the possible beginnings of a protracted global conflict between nuclear powers, and economic expectations have turned grim.

The world is marching towards a greener future on the industrial demand front, trending towards a greater reliance on clean energy sources. Oil is the engine of our modern economy. Yet, green energy’s expanding influence will only serve to fuel more demand for silver.

Strong retail demand for silver continues unabated, and sourcing low-cost silver bullion has posed many challenges. Under these conditions, retail silver supply will be playing catch up for some time, and wholesale costs will remain high. That’s why, here at PIMBEX, we work tirelessly to provide the lowest possible retail prices on our entire selection of silver and gold bullion products.

How to Take Advantage

Inflation is already taking hold of our everyday lives. Now, more than ever, it makes perfect sense to create as diverse an investment portfolio that counters inflation and is also reasonably affordable. True portfolio diversification is achieved when a decided portion of your holdings is removed from the risk of further currency devaluation.

Whatever strategies you employ to protect yourself and your loved ones, remember this: maintain a level head and take sensible steps towards your goals. History is on silver’s (and gold’s) side.